What Is Accidental Death & Disablement (ADD) Insurance—and Why Life Insurance Alone Isn’t Enough

Listen to this audio in the background if you got your hands full, whether that's driving, doing the household chores, walking, or lifting some weights. You can also increase playback speed to 1.5-2x.

You might think—“ah di ko naman kailangan ng accidents insurance”

Because you’re healthy. You don’t ride a motorcycle. You’re careful when you drive.

But here’s what no one tells you: Accidents don’t care how prepared you feel.

One moment, you’re paying a toll with your family in the car.

The next, a speeding bus crashes into the line—and your child becomes an orphan.

One moment, your daughter is running to hug you at the airport.

The next, a driver panics and steps on the accelerator—and she never makes it to your arms.

One moment, you’re backing out of your garage.

The next, you realize your toddler was behind the car the whole time.

These are real stories. Real news that happened just weeks apart. Sometime around May 2025. And they happened to people who didn’t expect them either.

That’s why this I wrote this blog.

You insure your car. You insure your phone. But if something happened to you, are your loved ones protected?

By the end of this post, you’ll know:

What Accidental Death and Disablement (ADD) coverage actually is (and what it’s not)

What accidents are covered (and which ones are not)

How much you or your family could receive in case something happens

The most common mistakes people make with their insurance

And how to quickly check if you’re truly protected—or dangerously underinsured

Let’s break it down.

What Is ADD Coverage?

If you already have life insurance, you might assume you’re fully protected. But most life insurance plans only cover natural causes of death.

What happens if you die because of an accident? Or survive, but lose a limb or your ability to work?

That’s where Accidental Death and Disablement (ADD) comes in. ADD coverage gives you an extra payout if your death or injury is caused by an accident.

It’s not a replacement for life insurance. It’s an add-on benefit that stacks on top of your existing coverage.

The Two Parts of ADD:

Accidental Death Benefit & Disablement Coverage

When people hear “Accidental Death and Disablement,” most assume it’s only about death.

But there are actually two types of benefits that fall under ADD:

1. Accidental Death Benefit

ADD coverage gives your family an extra cash payout if your death is caused by an accident—on top of your existing life insurance.

If you already have life insurance, you might think you’re covered either way. But here’s the truth:

💡 Life insurance pays for natural causes. ADD pays for accidental causes.

And yes—those two are treated differently in claims.

Let’s say you have a life insurance plan worth ₱2,000,000. If you pass away due to illness, your family receives ₱2M.

But if your death is caused by an accident, and you have an ADD rider worth ₱100,000? Your family receives ₱2.1M total.

Breakdown:

₱2,000,000 (life insurance)

₱100,000 (ADD rider)

= ₱2,100,000 total benefit

This is protection on top of protection.

✅ Check your policy. Look for “Accidental Death Benefit” or “ADD Rider.”

✅ Ask your advisor if ADD is included—and how much the coverage is.

✅ If you don’t have one, you can request to add it (usually at a very low cost).

2. Accidental Disablement

An accident doesn’t have to kill you to change your life. Many can leave you permanently injured—and unable to work.

That’s where the accidental disablement part of ADD comes in.

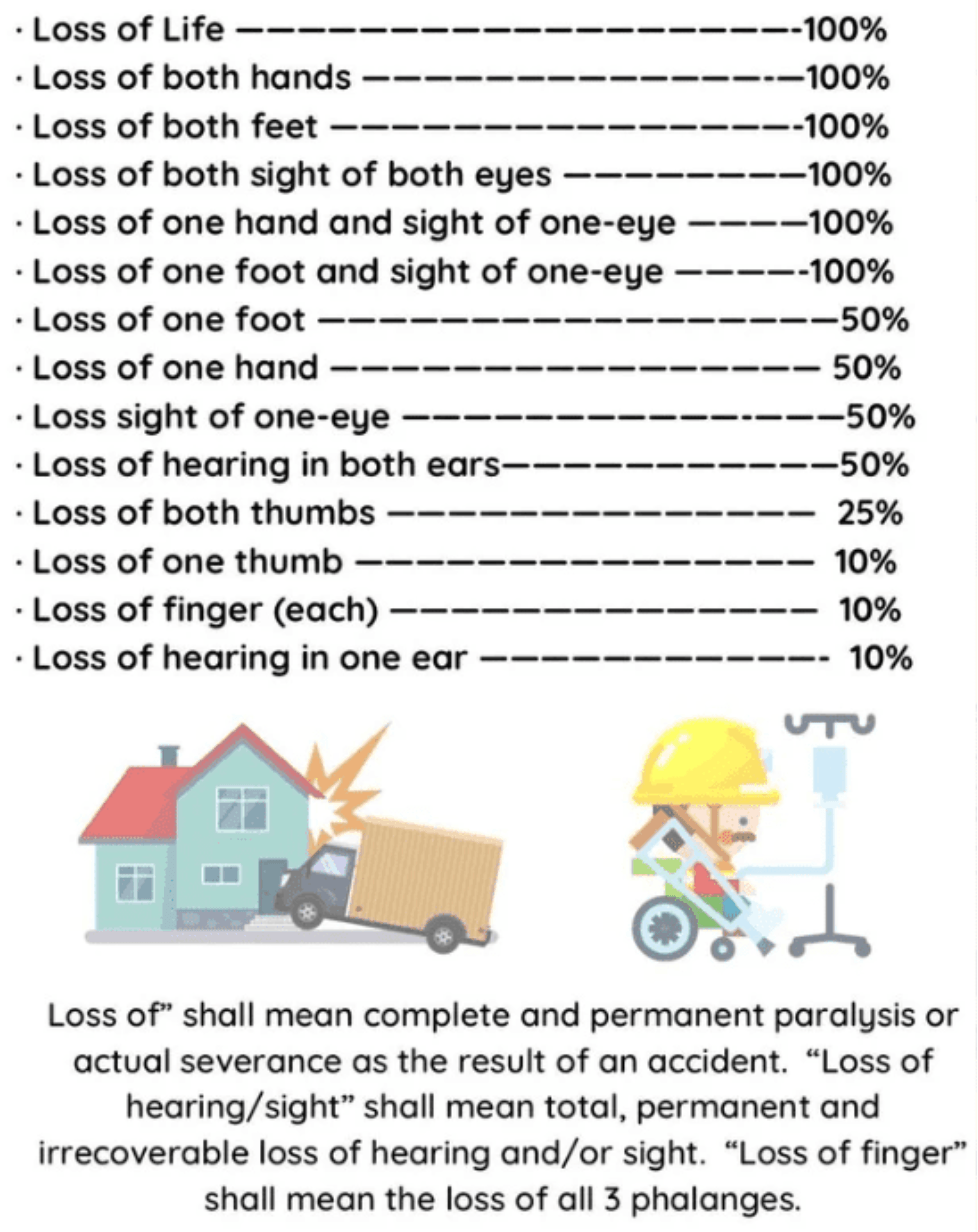

If an accident causes permanent loss of a body part or function, you’ll receive a partial payout, based on what was lost.

Note: Percentages may vary depending on your plan. Talk to your financial advisor.

Example: If your ADD benefit is ₱100,000 and you lose one hand, your payout is

₱50,000

This money can help you recover without draining your savings. Expenses such as:

Therapy expenses and doctor’s fees

Mobility aids or home adjustments

Daily bills—especially if you can’t work for months (or at all)

Ask your advisor: How much disablement coverage do I have?

If you don’t see it in your contract, it might be missing—or too low

Make sure your coverage reflects both death and injury risks

Friendly Tip:

Always Read the Fine Print That Can Void Your Claim

Not all accidents qualify for an ADD claim. Even if the injury was serious or life threatening, your claim can still be denied if certain conditions weren’t met.

That’s why it’s important to know the fine print of your policy.

Common Exclusions in ADD Coverage

Here are some of the most common reasons an ADD claim might get rejected:

❌ Self-inflicted injuries (intentional harm, suicide, etc.)

❌ Violation of traffic laws (e.g., beating the red light, overloading, illegal turns)

❌ Not a ticketed passenger during vehicular accidents

One misstep—like not wearing a helmet—could mean your family gets nothing. Even if you mean well, your actions at the time of the accident affect your eligibility.

What About Motorcycle Accidents?

Many clients ask: “Covered ba ang motorcycle accidents?”

Technically, most ADD plans exclude motorcycle-related claims.

But in practice, some claims have been approved—case-by-case—as long as:

The rider was not at fault

There was no collision involved

All police and medical documents were complete and submitted properly

So while there’s no guarantee, it’s not a dead end. The key is documentation.

How To Stay Claim-Ready

Remember: ADD is meant to protect you. But only if you protect your end of the agreement too.

You can protect your right to claim by following these best practices:

Always wear your helmet or seatbelt

Follow traffic rules—even if you’re in a hurry

Never drink and drive

Get a police report or incident report, even for minor accidents

Don’t engage in any reckless behavior

These small steps make a big difference when it’s time to file a claim.

To summarize, here are the main points you should never forget:

Accidental Death Benefit = extra cash for your family if you pass away from an accident.

Disablement Coverage = partial payout if you lose a body part or function (ex: 50% if you lose a leg).

Reminder: Follow traffic rules. Claims can be denied if you’re at fault.

Bonus tip: Motorcycle riders might still get claims approved—but case-by-case basis.

Your Next Steps:

Talk to a Financial Advisor

If you’re someone who:

Commutes daily (especially on a motorcycle or public transport)

Has kids depending on you

Works in a high-risk or active job

Or simply wants peace of mind…

Then ADD should be part of your protection plan.

Do your kids and family a favor today. Talk to a financial advisor.

When you do, ask your financial advisor these things:

How much is the ADD coverage amount in my current plan?

Does it include both accidental death and disablement?

Are motorcycle or commuting incidents excluded?

At the end of the day, the best way to be protected… is to not be the cause of the accident.

➕ Want Protection That Covers Even Minor Accidents?

ADD is for major incidents.

But what if you break a bone, get stitches, or can’t work for 2 weeks after a fall?

ADD doesn’t cover that. You need a Personal Accidents coverage plan.

➡️ Read this next: “What Counts as a Personal Accident—And What Doesn’t”

(A guide to Personal Accident insurance and why ADD alone isn’t enough.)

Queen Bee of Finance

Get Smarter with Your Money

Want more cool money tips?

Join our Buzz Letter

Every Monday, I'll share how real people use their savings, investments, and insurance to fund dreams, solve problems, and create opportunities.

Plus, I share free tools, like the Inflation-Proof College Fund Calculator, along with practical guides on lifetime income strategies and protecting your loved ones.

➡️ SIGN UP HERE ⬅️

Empowering Filipinos to unlock their wealth potential and help them be financially responsible.

Newsletter

Don’t miss out on more valuable tips on money management and securing your financial future. Delivered directly to your inbox, every Friday.

Subscribe to our

The Buzz Letter

(Weekly Newsletter)

Created with ©systeme.io