The Ultimate College Fund Savings Guide for Filipino Millennial Parents (2025)

Listen to this audio in the background if you got your hands full, whether that's driving, doing the household chores, walking, or lifting some weights. You can also increase playback speed to 1.5-2x.

As a parent, have you imagined this before you go to sleep?

Your child, already grown up, and deciding what course to take. He or she comes up to you and says:

“Dad, I’ve decided to take up medicine”

“Mom, can we afford to study aviation? I want to be a pilot”

“Dad, I want to join my other classmates. They’re going to boarding school abroad.”

Will your funds be ready for that moment?

What are you doing NOW to prepare for your child’s college tuition fees?

Make sure to stick to the end, cause I’ll be sharing a FREE Education Fund Cheatsheet so you don’t have to Google every option anymore. You’re welcome!

Why Most Parents Delay Saving

(And Why It’s a Costly Mistake)

You know where I think most parents fail? THEY DID NOT PREPARE.

When that happens, kids are forced to step up and provide for themselves—through scholarships, part-time jobs, or relying on relatives. Some even drop out of school because tuition is simply unaffordable.

Many parents think they need a huge amount of money to start saving for college. But starting small and being consistent is far more effective than waiting for “the perfect time.”

Why? Because inflation doesn’t wait for you.

Tuition Costs Are Soaring by 8.8% Every Year

That means today’s tuition of ₱50,000 could double in just 8 years—without warning.

You can’t stop inflation. You can’t control school fees.

But you CAN control how early you start preparing. Your best solution? Securing your child’s education plan early, while they’re still young. As in crawling in their diapers young!

Start building their educational fund before they can even call you ‘Mama’ or ‘Papa’.

How to Build Your Child’s Education Fund

(No Matter Your Budget)

In this post, I’ll help you build an education fund that works for your family, no matter your financial situation.

The good news? You don’t need to be rich to start. You just need the right plan.

I’ve divided the options into 4 tiers according to household income.

Now, let’s explore which education fund strategy fits YOU best. 👇

Household income is the combination of the salaries of both parents. If you’re a single parent, your sole income is your household income.

Don't have time to read everything now? Get the Education Fund Cheatsheet (scroll down to the last section of the page) – a simple, one-page guide to help you choose the best savings option for your child’s future!

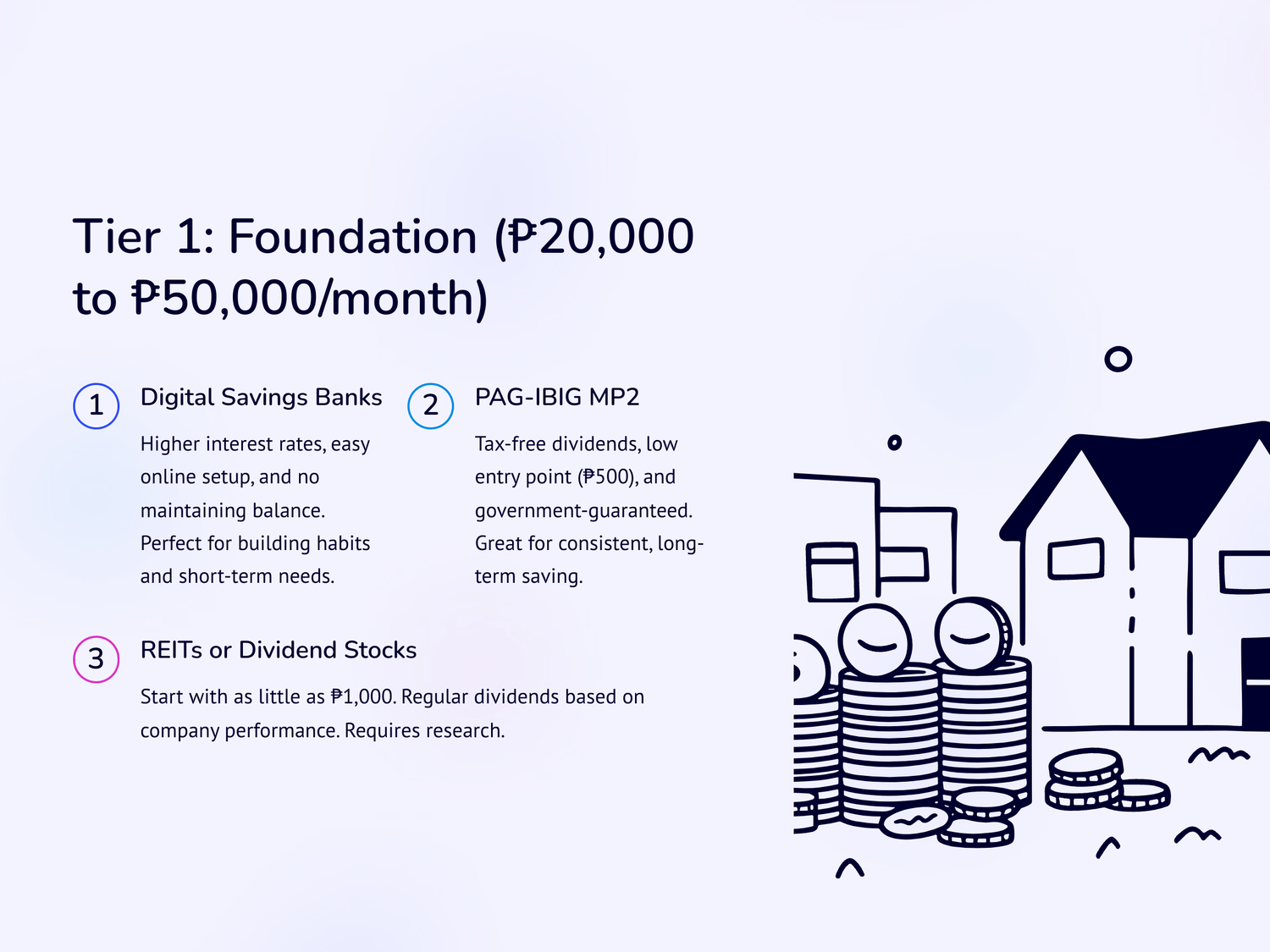

Tier 1: Foundation

Tier 1 is about building an education fund with small consistent savings.

This is like building a sturdy, immovable foundation for your home. The materials don’t need to be glamorous, it just needs to be functional. And being functional focuses on two things—stability and accessibility.

If you belong to Tier 1, your goal is to create a financial habit and establish a foundation for long-term saving, even with a limited budget.

How? You do this by starting with small, consistent savings and putting them in low-risk vehicles such as:

🟢 Digital Savings Banks

You probably heard of this one, right? If you have Maya, Gsave (from Gcash), Tonik, Seabank, or my favorite, GoTyme, you're earning a much higher interest rate than traditional banks like BDO/BPI.

Why is it perfect for newbies just starting to build their finances?

First, there’s no need to visit a branch—just download the app and sign up from your phone.

Second, there’s no maintaining balance. Unlike BDO or BPI, no need to maintain ₱3,000 to avoid fees.

Free fund transfers! Traditional banks may charge ₱10–₱25 per transaction.

Promo rates! Look out for their offers. Depending on the parameters, you can enjoy additional interest rates on your savings if you’re a new customer or have reached a certain amount of ADB (average daily balance). Example: When GoTyme started, they offered a promo interest rate of 5% p.a. Currently, they updated the terms to just 3% p.a. interest rate. For comparison, interest rates on savings for traditional banks do not exceed 1% p.a.

I know it can be hard to trust online banks, but there’s definitely no need to fret because, much like traditional banks, they are also regulated by the Bangko Sentral ng Pilipinas. As long as they belong to BSP’s list of digital banks in the Philippines, you can rest easy that they’ll secure your money.

Digital banks offer a safe, easy, and flexible way to grow your money faster for short-term education needs or emergencies. This blog post right here features my favorite banks ➡️

🟢 PAG-IBIG MP2 Funds

If you see PAG-IBIG contributions in your payslip, that refers to PAG-IBIG MP1 funds—a mandatory savings program paid jointly by the employer-employee.

PAG-IBIG MP2 funds, on the other hand, is their voluntary savings program, meaning you can save at your own pace and still enjoy high returns.

I first heard of MP2 funds during the pandemic, when it boomed to 6% p.a in dividends.

Why is MP2 great for beginner savers?

No taxes! The government won’t deduct anything from your dividends. That will already be your take-home savings.

You’re discouraged to withdraw your money. The maturity is set at 5 years. For sure, your money is safe from the perils of online shopping. Yay!

Save as low as Php 500. Remember—starting small and being consistent is far more effective than waiting for “the perfect time.

Guaranteed by the government. This is managed by PAG-IBIG, a government sector. So rest assured, your money is safe from default risks.

Visit the PAG-IBIG website if you have further questions about MP2 funds.

🟢 Dividend Stocks

Just like MP2 funds, private companies also give dividends to their investors through dividend stocks. Examples like real estate investment trusts (REITs) or PSEi stocks give you regular earnings based on their company performance.

This option may not need much money to start saving, but you’ll need to do some research.

1. First, research on stockbrokers: Preferably, online stockbrokers so you can access your account immediately and monitor/execute your trades.

2. Second, research companies: When choosing the REIT or stock company, study the history of their dividend rates, financials, and executive leadership. No matter how small your capital is, you are still an investor—so don’t skip the research.

3. Third, look at their dividend rate history: Dividend rates are public information—you can find this in PSE (Philippine Stock Exchange) financial reports. See example data here.

Why are dividend stocks great for beginner savers?

Low capital! Retail investors can start as low as Php1,000, depending on your stockbroker.

Ever heard of passive income? Depending on the schedule, these companies issue quarterly or yearly dividends based on your capital.

Tier Two: Strengthen Structure

This is the stage where you build the walls to strengthen the house and put a roof over your head to protect you from unpredictable weather.

Families in this income range can allocate more to savings while securing an income protection plan. If you belong to Tier 2, your goal is to gradually grow savings while protecting against life’s uncertainties.

Here’s how you’ll do that:

🟢 Whole Life InsuraVest Plans

Let’s say you earn good income. Your basic needs (food, shelter, clothing, utilities) are taken care of. A few savings here and there.

Life feels stable—until one day, you need urgent surgery or face a critical illness.

💰 Will your savings be enough to cover both medical bills and tuition fees?

💼 Can your family manage financially if you’re unable to work for months?

🎓 Will your child’s education suffer if your resources are drained by unexpected expenses?

This is where insurance+investment plans come in.

A long-term InsuraVest policy is like a safety net that also grows your money. It provides coverage in case you face disabilities, accidents, and hospitalization. But when those don’t happen (thank God), your investment money still multiplies with compounding interest.

InsuraVest plans can act as both a financial shield and an education fund, helping you protect your loved ones while still growing your wealth. Because your policy is not just for emergencies. It can also fund your dreams, like providing the best education for your child.

Why do long-term InsuraVest policies work best for Tier 2 families?

They’re cheaper to maintain and they last long. For as low as PHP 1,800 per month, you can get a coverage of benefits up to age 100, You don’t have to start big. Just start.

They provide income when you are not able to. You’ll have peace of mind that no matter what happens, you’ll continue providing for your family even if you can’t work due to illness or injury.

You can withdraw to fund your child’s college tuition. While you pay cheaper premiums, not only do you get insurance coverage. You’re also slowly building your investments so that when the time comes, you can pay for your child’s tuition.

🟢 Time Deposits

A Time Deposit is like a locked savings account that earns higher interest because you agree not to withdraw your money for a set period (e.g., 1 to 5 years). The longer you keep your money in, the higher the interest rate you earn.

Example: CIMB has a time deposit account called MaxSave that gives out 6% p.a. interest rate for a holding period of 12-24 months.

If you deposit ₱100,000, in one year you’d receive:

₱107,000 (Gross Amount) – Before tax.

₱105,600 (Net Amount) – After 20% withholding tax on the interest earned.

Why are time deposits suitable for Tier 2 families:

You can’t touch your funds. Not until your account matures. This helps parents who struggle with impulse spending because the money is locked until maturity.

Earn higher interest: Since you commit to not withdrawing, the bank rewards you with better rates. To compare, the savings account for CIMB Gsave is 2.6% p.a. (average) while their time deposit rate is 6% p.a. That’s almost triple the compounding growth!

Here’s a comparison between time deposit rates of traditional and digital banks:

🟢 Retail Treasury Bonds (RTBs)

We usually call government bonds as retail treasury bonds (RTBs). Instead of keeping your money in a regular savings account, you "loan" it to the government, and they pay you back with interest over time.

Example:Landbank of the Philippines issued RTB-30 last February 2024. A 5-year term bond that pays an annual fixed interest rate of 6.25% with a minimum capital of Php5,000.

Let’s say you invested ₱50,000. In the next 5 years, you will earn ₱3,125 every year in interest. And by the end of the 5th year, you get your ₱50,000 back.

Why are RTBs good for Tier 2 families:

Government-guaranteed: RTBs are issued to fund government projects. There’s little to no risk of the Philippine government going bankrupt, as taxes are managed well.

Great for Long-Term Savings: Like a time deposit, but typically with higher, fixed interest.

RTBs are perfect for families who want guaranteed earnings while keeping their money secure.

🟢 Unit Investment Trust Funds (UITFs)

A Unit Investment Trust Fund (UITF) is like a community piggy bank where several people put their money together to invest in bigger opportunities. Why manage your own investments if you can let a professional fund manager do it for you?

Example: Imagine you and 100 friends each chip in ₱1,000. That gives you ₱100,000, which a fund manager can use to invest in high-quality stocks or bonds that would have been too expensive to buy individually. When those investments grow, so does your share of the fund!

Why UITFs are great for beginners:

Hands-off investing: Experts manage everything for you.

Lower starting amount: You can start with as little as ₱1,000.

Diversified: Your money is spread across different investments, reducing risk. Plus, UITFs are regulated by the Bangko Sentral ng Pilipinas.

🟢 10-Year Endowment Plans

An endowment plan is where you save up money for a limited time, in exchange for guaranteed payouts for the rest of your life.

Think of it as "forced savings with benefits"—you save for 10 years, and in return, you get guaranteed yearly payouts for life plus insurance coverage for added financial security.

Example:Prulifetime Income is a 5- or 10-year plan that pays out 5% of your insurance coverage every year until 100 years old. So think of it as a future yearly allowance for your kid, and also your regular pension (to add to your SSS/GSIS benefits) during your retirement years.

Oh, and proceeds are tax-free by the way!

Why are 10-year endowment plans perfect for education funds?

Guaranteed Payouts for Life: Endowment plans guarantee a steady source of income for years, unlike stocks and bonds.

They provide inheritance money: Includes insurance coverage so your family is secured if anything unexpected happens.

Structured Payouts: You can align them with tuition schedules (e.g., high school and college).

Tier 3: Finishing Touches

Once the structure is secure, you can focus on enhancements that add long-term value.

- Add in some furniture

- Paint the walls with your favorite color.

- Start buying some appliances.

- If you have the budget for it, get an interior designer even!

In other words, families in this income range can afford to invest more aggressively, because they can afford more options.

If you belong to Tier 3, your goal is to grow wealth significantly while ensuring liquidity and access to funds for educational milestones.

🟢 Limited-Pay InsuraVest plans

Rather than whole-life or 10- to 20-year plans, Tier 3 families have the resources to allocate higher premiums with 5-year plans. Think of it like a big purchase that needs an installment basis.

Example: A car loan

You pay Php 30,000 for the next 5 years, right? And then the car is yours, fully paid. End of payment. But after 5 years, your car depreciates in value.

Let’s say you did the same—Php 30,000 for the next 5 years—but for your limited-pay InsuraVest policy this time. After 5 years, your payment ends but your investment continues to grow. Your funds appreciate in value because of compounding interest. Plus, you get insurance coverage for life (even if you only paid for 5 years).

🟢 5-year Endowment Plans

If 10 years of paying for an endowment plan sounds like a looooong commitment for you, you can shorten it to half—only if you have the capacity to pay much higher.

Going back to the car loan example, where you pay Php 30,000 for 5 years and you’re done.

In a 5-year endowment plan, you pay Php 30,000 for years, you’re done paying, AND you start receiving payouts. For life.

Too good to be true? Well, that’s why this has a higher price value. Because you are leveraging on both time and money at the guarantee of earning passive income for life.

🟢 Off-Shore ETFs

Exchange-traded funds are like a basket of investments from different companies off-shore. It could be a mix of tech (e.g. Apple, Google), manufacturing (e.g. Tesla), and all sorts of companies.

Instead of putting all your money in the Filipino companies, you spread it out worldwide, so you’re not relying on just one economy.

It’s like planting apple trees in the U.S. vs. planting a mango tree in your backyard. The apple tree grows faster and will probably sell for more because U.S. has one of the strongest economies in the world.

Compare that to your mango tree at home—it grows, yes, but oh so slowly.

We may not control the economy where we live. But we control where we invest our money. That’s why offshore investments help your education fund grow more than just saving locally.

However, this one needs a bit more research—especially when choosing your brokers. With a bit of due diligence, you can start your off-shore ETF wherever you are in the world.

Tier 4: Expansion

At this stage, you can extend the boundaries of your home.

- Add an additional floor. From a 2-storey house to a 5-storey house.

- Build a swimming pool for the kids to play in every weekends.

- Build a greenhouse garden for you to get your hands dirty.

- Expand and make a family compound.

Families in this bracket focus on legacy-building while securing education funds as part of a broader financial strategy. As in building passive income streams.

If you belong to Tier 4, the goal is to achieve financial freedom while creating a lasting legacy for your children and future generations.

This is now your exit plan. If your life was a movie, Tier 4 would be the third act.

This is now your exit plan. If your life was a movie, Tier 4 would be the third act.

🟢 Lump Sum InsuraVest plans

In other words, these are your one-time pay InsuraVest policy. You only need to pay once, and then you park it there.

Let it sit. Forget about it. Focus on your passions in life.

After a few years, when you least expect it, your one-time deposit has now grown so much. More funds for retirement.

But this one-time payment could weigh a ton, especially for those in Tiers 1 and 2. It could range from Php 500,000 to Php 2,000,000—even more!

Example:PruMillionaire starts at Php 1,000,000. Leave it there and let it grow while getting life insurance coverage until 100 years old.

If you have funds sitting coldly in your bank that you don’t need anytime soon, you can park it here.

🟢 Rental Income

Imagine this—your son/daughter tells you it’s enrollment time and he/she needs Php 70,000 to start the semester.

Would you source that out from your salary? What about your monthly living expenses, such as electricity, groceries, and gas?

How about this instead—what if other people pay that Php 70,000 tuition fee for you? Instead of working extra hours to save for tuition, your tenant pays you every month—just like a salary.

To put it straight—your tenants pay for your child’s education.

Mind you, buying properties isn’t cheap. That’s why you should start now if you want a different income stream providing for your child’s education.

If you invest PHP 5,000 in a rental property (e.g., for down payment), it can pay you PHP 20,000/month in rent later on.

Or if you buy a foreclosed property from PAG-IBIG at a discounted price, you can get a house or condo for 20-30% below market value, with low down payment options. Renovate it, and rent it out for PHP 10,000/month.

When your son/daughter graduates, you still own the property! You can keep renting it out for extra income or sell it at a higher price.

🟢 Stocks and Direct Investments

Instead of just eating at Jollibee, what if you own part of Jollibee and earn when it grows?

Stocks let you become part-owner of big companies (e.g., SM, Ayala, BDO, Jollibee). When these companies make more money, your investment grows too—helping you fund tuition.

If you want more control over where your money goes, the same is true for direct investments. Like franchises for example. Buy a small food cart or online store that generates income for tuition.

Stocks and direct investments are like planting seeds in fast-growing soil—they can grow faster than savings accounts, but you need to nurture them properly.

Your Next Steps:

Start Planning with Confidence

I believe we operate in seasons. Right now, you may be at Tier 1, still starting out in managing their finances. But it doesn’t mean you stay at Tier 1 forever.

Eventually, you’ll move your way up to Tier 2, then to Tier 3, and finally to Tier 4.

How fast you move up? That depends on how quick you take action.

Knowing what to do is just the first step—the real progress happens when you take action.

So, what’s next?

📌 Step 1: Choose the right tier that fits your current finances and future goals.

WE’VE COVERED THIS ALREADY. The best part?

I summarized everything in a one-page cheatsheet to save you time. Plus, it’s free. Download your College Fund Cheatsheet below.

📌 Step 2: Calculate how much you need to save based on tuition projections and inflation.

Need a quick way to figure out your savings goal? Download our Free Education Funding Worksheet—a simple, easy-to-use tool that calculates how much you need to save based on your child’s age and dream school.

📌 Step 3: Take the first step today—even small, consistent savings make a huge difference over time.

Not sure where to start? Let’s schedule a discovery callwhere we start talking about what your goals are and then go from there.

I got you the tools and I got you the 1-1 guidance. It’s your turn to take action.

Your child's future starts today. Take the first step now!

Education Costs Are Rising: Tuition fees increase by an average of 8.8% per year—waiting too long makes saving harder.

Why Start Early?

More Time, Less Stress: Small, consistent savings now mean less pressure later.

Beat Inflation: The earlier you start, the more your money can grow and keep up with rising tuition.

More Options: You can choose low-risk savings or high-growth investments based on your budget.

Choose an Education Funding Strategy That Fits Your Budget:

Tier 1 (Foundation): Start with low-risk options like MP2, digital banks, or RTBs.

Tier 2 (Growth): Mix protection with growth—investment-linked plans, time deposits, or UITFs.

Tier 3 (Wealth Building): Higher-return investments like real estate, REITs, or offshore ETFs.

Tier 4 (Legacy Planning): Build passive income streams for long-term education funding.

Helpful Tools:

One-Page Education Fund Cheatsheet – A quick guide to all college savings options at a glance.

Inflation-Proof College Funding Worksheet – Calculate how much you need to save for your child’s university.

Queen Bee of Finance

Get Smarter with Your Money

Want more cool money tips?

Join our Buzz Letter

Every Monday, I'll share how real people use their savings, investments, and insurance to fund dreams, solve problems, and create opportunities.

Plus, I share free tools, like the Inflation-Proof College Fund Calculator, along with practical guides on lifetime income strategies and protecting your loved ones.

➡️ SIGN UP HERE ⬅️

Empowering Filipinos to unlock their wealth potential and help them be financially responsible.

Newsletter

Don’t miss out on more valuable tips on money management and securing your financial future. Delivered directly to your inbox, every Friday.

Subscribe to our

The Buzz Letter

(Weekly Newsletter)

Created with ©systeme.io