Financial Advice Your Parents Didn't Get: Why Filipino Millenials Need Lifetime Income

Listen to this audio in the background if you got your hands full, whether that's driving, doing the household chores, walking, or lifting some weights. You can also increase playback speed to 1.5-2x.

"How did our parents pull it off?"

If you're a millennial like me, you might have asked this question yourself.

They married young, had multiple kids, sent them to school, and bought a house and car—all without thinking twice. They decided what they wanted and figured it out along the way.

But for us millennials, it’s different:

We hesitate over whether we can afford just one kid’s tuition. Let alone have children in the first place! Might as well be fur parents in this economy, right?

We’ve got it tough.

While our parents may have relied on pensions, social security, and a steady job market, these are no longer sufficient or applicable for millennials.

We need a new approach.

One that might not have been on the radar for our parents: building a lifetime income strategy in our 20s and 30s.

How Does Lifetime Income Look Like?

Lifetime income means getting paid, even when you stop working—right up until you pass away. And when that time comes, you leave the rest as an inheritance for your family.

Here's how it works. Let's say you started investing for your future at 27 years old.

You set aside money for 5 to 10 years. In return, you get guaranteed passive income for the rest of your life. You earn while you’re working, after you retire, and even provide for your family when you’re gone.

Planning ahead like this ensures you keep up with inflation, so your money doesn’t lose value over time.

Some special savings plans, called endowment plans, can give you money for your whole life. Endowment plans pay you regularly, just like a paycheck, for your entire life. Plus, they come with insurance to protect your family. It’s a smart way to secure income for your needs while also keeping your loved ones safe.

Why Lifetime Income?

The Old Rules Don't Apply

If you inherited money, property, or a family business, consider yourself lucky—not everyone gets that. Many Filipino families inherit hospital bills, debt, or genetic illnesses instead.

No one’s blaming our parents here—they did the best they could. (Let me put that out there before the Boomers come at me. Yikes!)

But now, with information at our fingertips (you literally clicked you're way into this post, right?), we can’t afford to repeat the past.

We should do better because times have changed. So what's stopping us?

1. We are easily distracted.

What's the first thing you do after you wake up? Check your phone, probably.

As soon as you open your social media feed, you see friends and celebs buying houses, taking vacations, and living it up. The FOMO is real, and it’s tempting to keep up.

But you know what really happens when we give in to social pressure?

We delay our priorities:

You delay getting that dream house for your family—as if you're content with renting or living with your parents.

You delay preparing for your child's college fund—as if time does not fly so fast.

You delay paying off your debt—as if you enjoy watching interests pile up.

You delay setting up your life insurance benefits—as if you're invincible.

You delay getting ample coverage for your critical illness—as if you're perfectly fit and healthy with no history of family diseases.

You delay protecting your income and growing your investments—as if you can keep your job forever.

You're not. Let’s be real: none of this is news to us.

Now, zoom out and ask yourself:

Am I willing to sacrifice 5-10 years if I knew I'd enjoy a lifetime of guaranteed passive income?

2. Inflation is crazy!

Have you noticed how expensive everything’s getting?

My weekly grocery run now costs me around Php 2,500—and that’s just for a single basket of essentials. Crazy economy, right?

Inflation eats away at your buying power, year after year. That's just how the economy works. Ain't nothing we gon' do about that.

Let's look at the numbers.

TUITION IS SKYROCKETING.

I took chemical engineering 8 years ago. A 5-year engineering course that costs about Php 30-40k per semester. Now? It’s around Php 70kper semester!

Take note: This does not include the miscellaneous fees and other student living expenses.

Meanwhile, your savings are fighting a tough battle. Traditional banks offer less than 1% interest, and even digital banks with 2-8% rates can only do so much—especially when “promo interest rates” are temporary.

So, here’s the harsh truth of life:

If you’re distracted or waiting for the "perfect time" to get serious about your money, you’re losing out—both on interest and to inflation.

Start planning now.

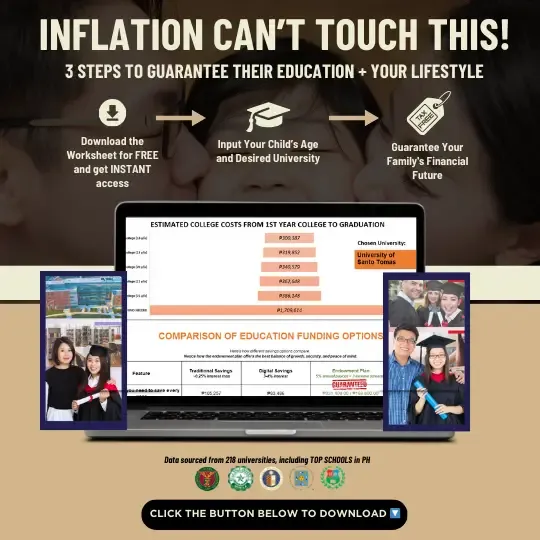

If you want to figure out how much you’ll need for your child’s college fund, try the Inflation-Proof Education Funding Worksheet I’ve made simple for parents.

Because time won’t wait, and the economy doesn’t care if you’re ready. The world’s not that nice.

Digital banks have something called "promo interest rates." This means they give you more money for saving with them, but only for a short time. It's like a special offer to get you to join or save more.

After the promo ends, the interest rate goes back to normal. Always check when the promo ends and what the regular rate will be.

3. We just want to retire early and earn passive income.

In this economy, a household earning dual income stands a greater chance of survival—especially if you're dreaming of starting a family.

That's why millennials are either savage side hustlers or corporate ladder hikers. And we're chronically tired from it.

Side hustles could mean burning the candle at both ends, hoping to eventually buy back your time and earn the freedom to live on your terms while providing for your family.

No wonder we're tired!

We’re different from past generations, grinding from 8 to 5 until 65. We’d rather retire in our 40s or 50s, with more time to explore the world, enjoy life, and make memories with our loved ones.

But here’s the catch: RETIRING EARLY IS NOT EASY.

It takes serious planning and sacrifice. Passive income sounds appealing, but it’s a long game. Question is: when do you plan to start?

Can You Do Better for the Next Generation?

To us millennials, we’ve faced tough times. But we’re also more informed than ever. We have the tools to do better than the generations before us.

And that means it’s up to us to make smarter choices—not just for ourselves, but for our (future) children.

I believe in personal development, and that’s why I advocate for lifetime income planning. It’s not just about creating a legacy of financial stability and freedom—it’s about empowering you to do better than the generation before us.

You’re already working hard; now it’s time to work smarter. Ready to start building that future?

Sign up below to download the Inflation-Proof Education Funding Worksheet. It’s free, and it’ll help you plan for your children’s college funds in a way that keeps up with rising costs.

Because it’s not just about “figuring it out” anymore—it’s about taking action TODAY for a better tomorrow.

Times Have Changed: Things aren’t like they were for our parents. We need to plan differently because money doesn't go as far as it used to.

Why Lifetime Income is Smart:

Forever Money: You save for a little while, and then you get money every year for the rest of your life.

Be Ready for Anything: Unexpected costs like hospital bills or school fees that keep getting higher.

Live Better: You can enjoy life more knowing you always have money coming in.

Start Early: It's best to start saving now, when you’re still younger. This helps make sure you have enough money later for things like school and even when you’re old and retired.

Helpful Tool: Download the Inflation-Proof Education Funding Worksheet. Plan how much you need to save for your children's school and avoid surprises as costs go up.

Queen Bee of Finance

Get Smarter with Your Money

Want more cool money tips?

Join our Bee-Informed Newsletter where I'll share exclusive tips on how to build wealth, plan for your family’s future, and stay ahead of inflation.

Plus, I share free tools, like the Inflation-Proof College Fund Calculator, along with practical guides on lifetime income strategies and protecting your loved ones.

SIGN UP BELOW.

Empowering Filipinos to unlock their wealth potential and help them be financially responsible.

Newsletter

Don’t miss out on more valuable tips on money management and securing your financial future. Delivered directly to your inbox, every Friday.

Subscribe to our

The Buzz Letter

(Weekly Newsletter)

Created with ©systeme.io